The Richard Heart Case Is Dead in the Water — And Crypto’s Sailing Free

In a MASSIVE development that could redefine the future of crypto regulation, the SEC has all but abandoned its case against Richard Heart.

April 21, 2025, was the last day for the SEC to amend its original complaint, which was previously thrown out back in February.

That came and went. No filings. No action.

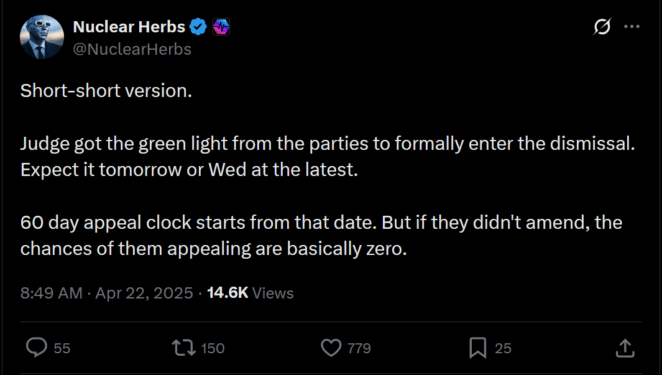

Now, a formal dismissal by the judge is expected within days.

While the agency technically has 60 days to file an appeal, its resounding silence speaks louder than any legal argument: they’re walking away.

Here’s what you need to know about what this means for HEX, PulseChain, and crypto as a whole.

PulseChain Just Stared Down the SEC — And Won

Since 2023, the SEC has been pursuing a lawsuit that accused Heart of raising over $1 billion USD through alleged unregistered securities tied to HEX, PulseChain, and PulseX. But this case wasn’t just about Richard Heart. It was about whether decentralized innovation could exist without being presumed illegal from day one.

The dark cloud hanging over PulseChain — nearly two years of legal overhang — is now gone.

This isn’t just a personal victory for Heart. It’s a thunderous win for the entire DeFi space. The lawsuit froze investor sentiment, stifled growth, and cast a chilling shadow over an entire community. But despite it all, PulseChain stood tall — and now it stands free.

According to Richard Heart’s handler on X:

"Richard Heart, PulseChain, PulseX, and HEX have defeated the SEC completely and have achieved regulatory clarity that nearly no other coins have. They're now safer to work with in ways that almost no other coins are.

The SEC walked away from some other cryptocurrency cases voluntarily, but this is the only case where the SEC lost and crypto won across the board."

Through two years of uncertainty, the PulseChain community didn’t fold. They weathered media hit pieces, relentless FUD, and the looming threat of federal action. And now, they’re not just standing — they’re vindicated.

PulseChain just survived one of the SEC’s most aggressive crypto attacks in recent memory.

The SEC Flinched. That Changes Everything.

This retreat might not just be the end of one case — it could mark the beginning of a broader regulatory pivot.

Under Gary Gensler, the SEC went scorched-earth on crypto, launching a barrage of lawsuits and leaning heavily on uncertain legal footing. But here? They didn’t even make it out of the gate.

Now, with Paul Atkins’ appointment indicating crypto-friendly SEC leadership, this moment might just be a bellwether for bigger changes ahead.

If you’re in the crypto space, this isn’t just news — it’s a milestone. The SEC’s billion-dollar case didn’t just fail; it evaporated. That’s more than a legal collapse — it’s a reputational blow. And it signals a potential power shift in how regulators approach crypto moving forward.

So if you stayed strong and tuned out the noise — this one’s for you.

The SEC may have fired the first shot, but it’s crypto that’s still standing, still building, and still winning.

Watch Our Latest Videos.

Subscribe!People Who Liked This Also Loved...

Disclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.