Trump’s Tariffs Just Cemented Bitcoin as Digital Gold

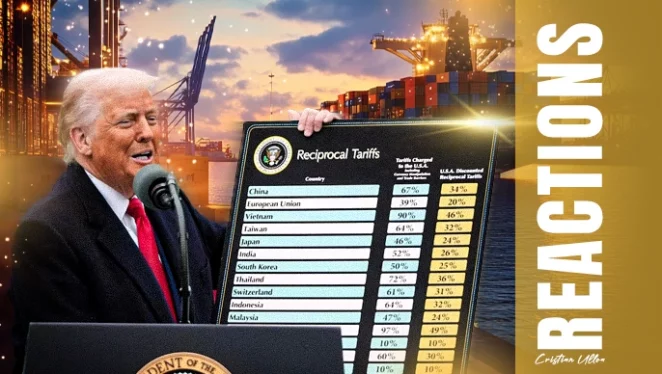

Donald Trump's tariff announcements have been a non-stop talking point, but there's one thing no one's talking about.

With the tariffs sending the world into a sudden state of shock. It's no surprise that equity and commodity markets responded sharply, with significant value being shed across the board. For many, tariffs are a reliable early signal that a recession is brewing — I’m not about to suggest otherwise.

But look past the surface, and we're seeing unprecedented crypto news take place right in front of us.

For perhaps the first time ever, Bitcoin isn't following the TradFi markets as closely as it once did. Instead, it's finally stepping into its role as digital gold.

Here's how that could be massive news for the longevity of crypto.

Gold and Silver’s Sudden Divergence

What’s probably upset a few commodity speculators is that we finally saw the solid relationship between gold and silver break — and break dramatically!

Gold held its own, but silver saw a 15% downturn.

This further reflects something we all know to be true: gold is a monetary metal, whereas Silver is not. As an industrial metal, silver is important nonetheless, but it’s certainly not traded like a currency in the same way as gold.

While both have value, only gold is treated by markets as a store of wealth — a role silver hasn’t convincingly claimed in years.

So the question is, did Bitcoin behave more like silver or more like gold?

Digital Gold: Bitcoin Lives up to Its Name

While hardcore Bitcoin proponents have long regarded BTC as a form of digital gold, Bitcoin has largely been regarded by TradFi investors as a speculative asset.

When the market as a whole begins to hurt, people often cash out their "speculative" plays into positions that are perceived as being more stable and long-term. For instance, tech stocks are often one of the first assets to take a dive when the markets become unstable.

Bitcoin typically follows suit, with tech stocks and BTC often following similar price trajectories when the market panics.

What's fascinating about the situation right now is that the coupling of Bitcoin and traditional assets seems to have finally split.

While BTC certainly took a hit in the wave of the Trump tariff panics, its performance more closely resembles that of gold right now.

To me, this suggests that many investors are starting to finally accept that Bitcoin is a long-term monetary store of wealth with similar characteristics to Gold.

This means more and more people will come to see BTC as a credible alternative store of wealth — especially with the US government building its own long-term Bitcoin reserves.

Bitcoin is changing in the eyes of most of the traditional financial pundits. It's going from a speculative play to being perceived as an alternative to Gold or at least its equivalent.

Whether or not you personally hold Bitcoin, this is massive news for the legitimacy of the crypto industry as a whole.

Watch Our Latest Videos.

Subscribe!People Who Liked This Also Loved...

Disclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.